Get started, planning your offshore wind farm project with Powersystems

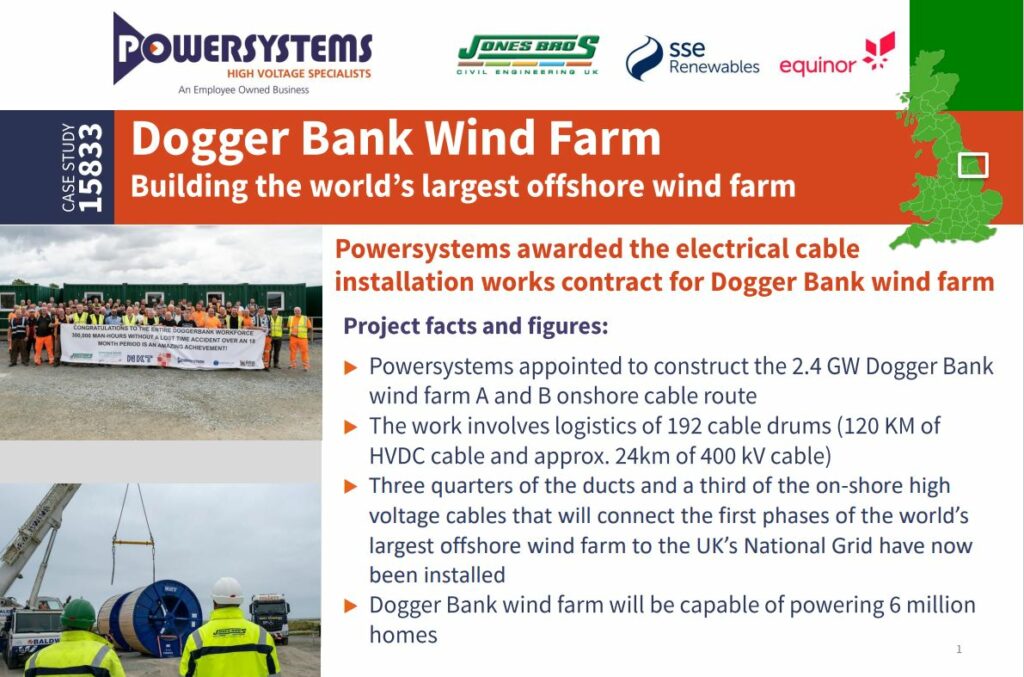

Building the electrical infrastructure for an offshore wind farm is a challenging project that requires teams of specialists to handle the many aspects of the project—from conception and planning to implementation.

Speak with one of our high voltage electrical engineering Wind Farm Specialists today.

Powersystems UK were appointed XXXXXXX XXXXXXXX XXXXX XXXXXXXX XXXXXX XXXXXXXX XXXXX XXXXXXXX XXXXXX XXXXXXXX XXXXX XXXXXXXX XXXXXX XXXXXXXX XXXXX XXXXXXXX XXXXXXXX XXXXXX XXXXXXXX XXXXX XXXXXXXX XXXXXX XXXXXXXX XXXXX XXXXXXXX XXXXXX XXXXXXXX XXXXX XXXXXXXX XXXXXXXX XXXXXX XXXXXXXX XXXXX XXXXXXXX XXXXXX XXXXXXXX XXXXX XXXXXXXX XXXXXX XXXXXXXX XXXXX XXXXXXXX XXXXXXXX XXXXXX XXXXXXXX XXXXX XXXXXXXX XXXXXX XXXXXXXX XXXXX XXXXXXXX XXXXXX XXXXXXXX XXXXX XXXXXXXX XXXXXXXX XXXXXX XXXXXXXX XXXXX XXXXXXXX XXXXXX XXXXXXXX XXXXX XXXXXXXX XXXXXX XXXXXXXX XXXXX XXXXXXXX

Powersystems UK were appointed XXXXXXX XXXXXXXX XXXXX XXXXXXXX XXXXXX XXXXXXXX XXXXX XXXXXXXX XXXXXX XXXXXXXX XXXXX XXXXXXXX XXXXXX XXXXXXXX XXXXX XXXXXXXX XXXXXXXX XXXXXX XXXXXXXX XXXXX XXXXXXXX XXXXXX XXXXXXXX XXXXX XXXXXXXX XXXXXX XXXXXXXX XXXXX XXXXXXXX XXXXXXXX XXXXXX XXXXXXXX XXXXX XXXXXXXX XXXXXX XXXXXXXX XXXXX XXXXXXXX XXXXXX XXXXXXXX XXXXX XXXXXXXX XXXXXXXX XXXXXX XXXXXXXX XXXXX XXXXXXXX XXXXXX XXXXXXXX XXXXX XXXXXXXX XXXXXX XXXXXXXX XXXXX XXXXXXXX XXXXXXXX XXXXXX XXXXXXXX XXXXX XXXXXXXX XXXXXX XXXXXXXX XXXXX XXXXXXXX XXXXXX XXXXXXXX XXXXX XXXXXXXX